california renters credit turbotax

EITC reduces your California tax obligation or allows a refund if no California tax is due. The refundable California Earned Income Tax Credit EITC is available to taxpayers who earned wage income in.

Homebuyer Tax Credit 7 Surprising Facts Turbotax Tax Tips Videos

60 for single or married filing separately with an adjusted gross income AGI of 40078 or less and.

. See How Easy It Really Is Today. I am confused on what principal residence means. Use one of the following forms when filing.

California Resident Income Tax Return Form 540 line 46. Tax Return Access. Residents of Manitoba who pay rent may be able to receive a credit of up to 20 of rent payments or 700 whichever is less.

Also the property being rented cannot be tax-exempt. 120 credit if your are. Does California - Nonrefundable Renters Credit apply to room renting.

Nonresidents cannot claim this credit. Can Housemates claim the Nonrefundable Renters Credit when Im the one. Start Your Tax Return Today.

Tax Filing Is Fast And Simple With TurboTax. Subtract the amount on line 47 from the amount on line 35. I lived on a off-campus apartment and my name is on a lease so I do pay rent.

It just says you need to have paid rent for half the year and a couple of other things that I meet. Posted by 11 months ago. Compare the Top Tax Software and Find the One Thats Best for You.

California This credit is similar to the federal Earned Income Credit EIC but with different income limitations. California Renters Credit. To claim the renters credit for California all of the following criteria must be met.

Can Housemates claim the Nonrefundable Renters Credit when Im the one who pays the rent to the landlord. Federal law lacks a credit comparable to the states Renters Credit. For example if you live in California you may qualify for a renters credit if you pay rent for your housing your income is below a certain amount and you meet other state requirements.

Does California - Nonrefundable Renters Credit apply to room renting. The other eligibility requirements are as follows. I have been living in CA.

Attach the completed form FTB 3913 to Form 540 California Resident Income Tax Return. 60 credit if you are. Calculate your portion of the rent only when filling out the application.

You must be a California resident for the tax year youre claiming the renters credit. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. The rent is paid my dad but my brother and me give him money.

For taxable years beginning on or after January 1 2021 taxpayers should file California form FTB 3913 Moving Expense Deduction to claim moving expense deductions. Line 46 Nonrefundable Renters Credit. I rent a room in a house in CA.

For more information on Manitobas Education Property Tax Credit see the following links. Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your principal residence is what they asked. If you live in Hawaii and earn less than 30000 per year but pay 1000 or more in rent for your principal residence you may qualify for a tax credit of 50 per qualified exemption.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Use Screen 53013 California Other Credits to enter information for the Renters credit. I am a college student filing independent.

See How to Generate the California Renters Credit for more information. SOLVED by Intuit Lacerte Tax 11 Updated August 20 2021. You paid rent for a minimum of six months for your principal residence.

If you paid rent for at least six months in 2021 on your principal residence located in California you may qualify to claim the nonrefundable renters credit which may reduce your tax. Under the Provincial tab select Provincial Tax Credits Profile then make sure to check the boxes Education Property Tax Credit rent paid and the next box Manitoba School Tax Credit proceed to the next screen which allows for input of your housing information. Yes California has a renters credit.

I dont see anything from the IRS saying there is a limit on how many people in a household can claim this credit. For Single filer it is 60. If you are Married Filing Joint the credit is 120.

To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. Manitobas Education Property Tax Credit. I have proof of this through the checks written out to my dad.

TurboTax will ask you the qualifying questions determine if you. Get Your Max Refund Today. For more information see Schedule CA 540 instructions and get form FTB 3913.

Ad All Major Tax Situations Are Supported for Free. Ad See the Top 10 Tax Software. In the California interview look for the section called Renters Credit.

Terms and conditions may vary and are subject to change without notice. Complete the qualification record. Posted by 1 year ago.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Widower How to claim. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident.

California requires those filing for the credit to have paid rent for at least half of the tax year. File your income tax return. A simple tax return.

Get Instant Recommendations Trusted Reviews. Current state law allows a nonrefundable credit for qualified renters in the following amounts for tax year 2017.

11 States That Give Renters A Tax Credit

Consumer Reports Car Insurance Survey Car Insurance Insurance Farmers Insurance

Does Irs Debt Show On Your Credit Report H R Block

Credit Cards Offering Tax Service Saving Rewards In 2022 Nextadvisor With Time

What Is A Good Credit Score For Renting A Home

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

2000 Turbotax Basic Intuit Turbo Tax Poirerbta Turbotax Credit Card Application Form Credit Card Application

Turbotax Refund Advance Loan Review Credit Karma

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Are Credit Card Rewards Taxable Nextadvisor With Time

What Are Personal Property Taxes Turbotax Tax Tips Videos

Securityplus Federal Credit Union Review Minority Led Credit Union

Where S My Refund How To Track Your Tax Refund 2022 Money

Quebec Property Owners Rl 31 Slips And The Solidarity Tax Credit

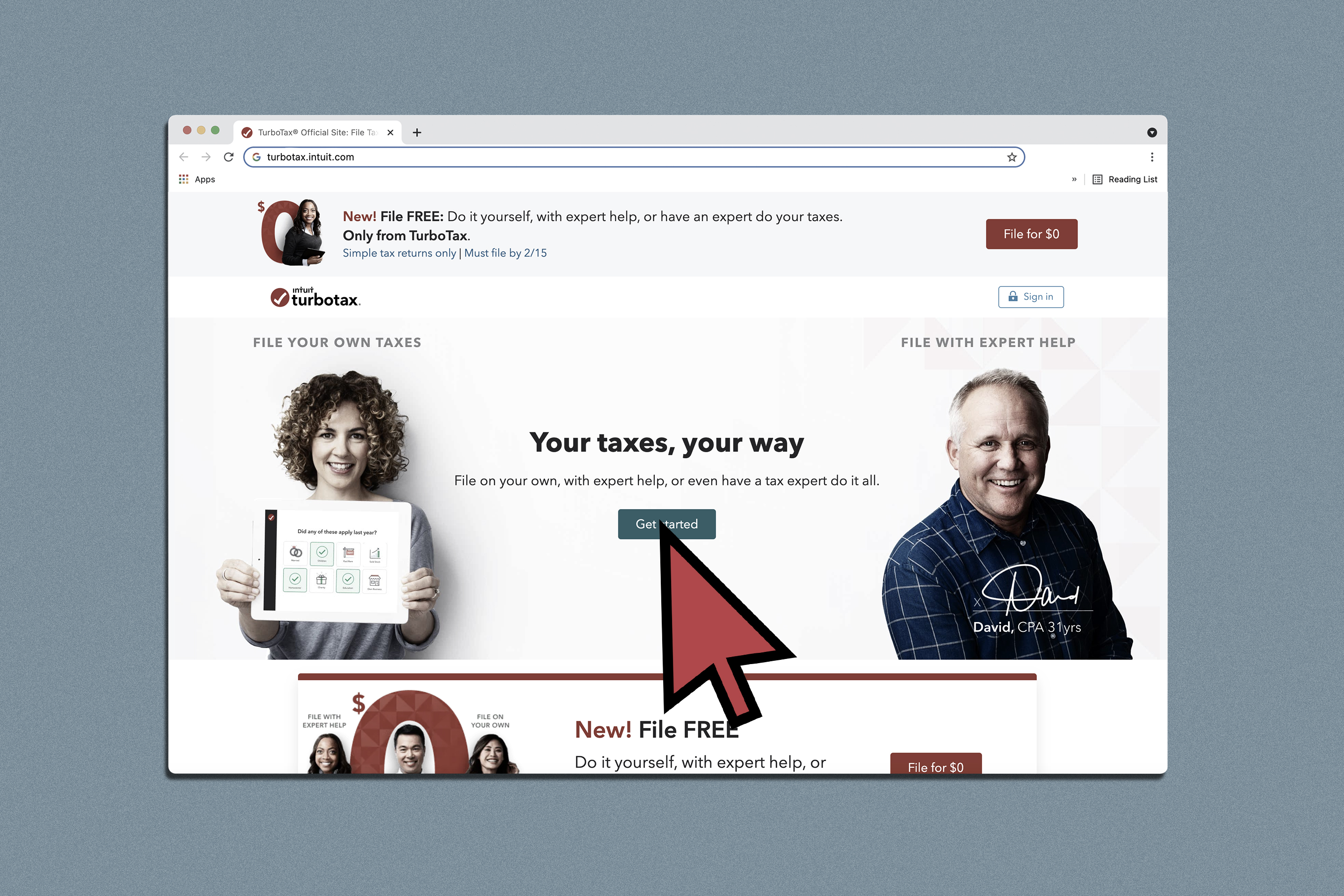

How To File Taxes For Free Turbotax 2022 Free File Change Money

Earned Income Tax Credit Eitc What It Is And Who Qualifies Bankrate